Waterbed liability insurance is a service that covers the damage or repair of your property that may result from any kind of waterbed-related accident. A waterbed can be a high maintenance product and it requires a lot of care and attention. Many kinds of mishaps are associated with waterbeds—they may be due to the development of a hole or a leak in the surface of the waterbed mattress leaving the property prone to water damage.

Waterbed liability insurance covers damage to furniture and property that could occur from a leaking waterbed. Typically it covers an insurance claim of about $300,000 and costs between $25 and $100 per month.

If you are a tenant in an apartment, and your waterbed leaks, it may cause severe damage to the property as well as the belongings of other tenants. If the floor is made of wood, there could be leakage, and water could drip from your room and cause damage to the room below. In such a case, you would be liable for all the costs incurred. That is when waterbed liability insurance would come in handy to save you from massive financial loss.

You may also be interested in learning whether or not you should use a waterbed on the second floor. Be sure to check out our related article to find out.

Waterbed liability insurance may seem unnecessary at first, but when you consider the hassle and expense of replacing a broken bed frame, as well as repairing the floorboards and other water-damaged furniture, then this type of insurance will give you peace of mind. This review from This Old House takes a look at State Farm Renters Insurance and could help you determine what insurance to buy for your waterbed.

What Is Waterbed Liability Insurance?

Waterbed liability insurance is a type of service that covers expenses due to water damage that could affect the property or the furniture.

Waterbed liability insurance covers any and all damage caused by a waterbed, including water damage and damage to furniture. Waterbed insurance may also cover water-leakage liability throughout the building.

Waterbed liability insurance could be required if you are renting an apartment or a furnished flat and you own a waterbed. Your landlord may or may not require this type of insurance from you, and this will be stipulated in the rental contract. Our comprehensive waterbed cost guide explains a bit more about how waterbed insurance works.

Is Waterbed Liability Insurance Different From General Liability Insurance?

General liability insurance services usually provide you with protection from different kinds of property damage claims, or personal injury claims. There are different kinds of general liability insurance, which could cover your business, your home, your land, or other immovable and moveable assets.

Waterbed insurance is different from general liability insurance. It is often an addendum to an existing insurance policy, which will cost an additional premium when instituted. Some general liability insurance companies may cover water damage.

Waterbed liability insurance is specifically related to the damage that could be caused by a waterbed and general liability insurance for homeowners may not include protection for water damage. Waterbed liability insurance was introduced recently, so that waterbed owners can be insured against the damage caused by any accident related to a waterbed.

Why Do I Need Waterbed Liability Insurance?

If you own a waterbed then waterbed liability insurance just makes sense. Knowing that you will be covered should your waterbed cause damage to your rental property or to the property of your neighbors, will give you peace of mind.

Waterbed liability insurance is necessary if it is required by a landlord. There are no state or federal requirements for waterbed liability insurance, but it may be a contractual requirement if you are renting a property.

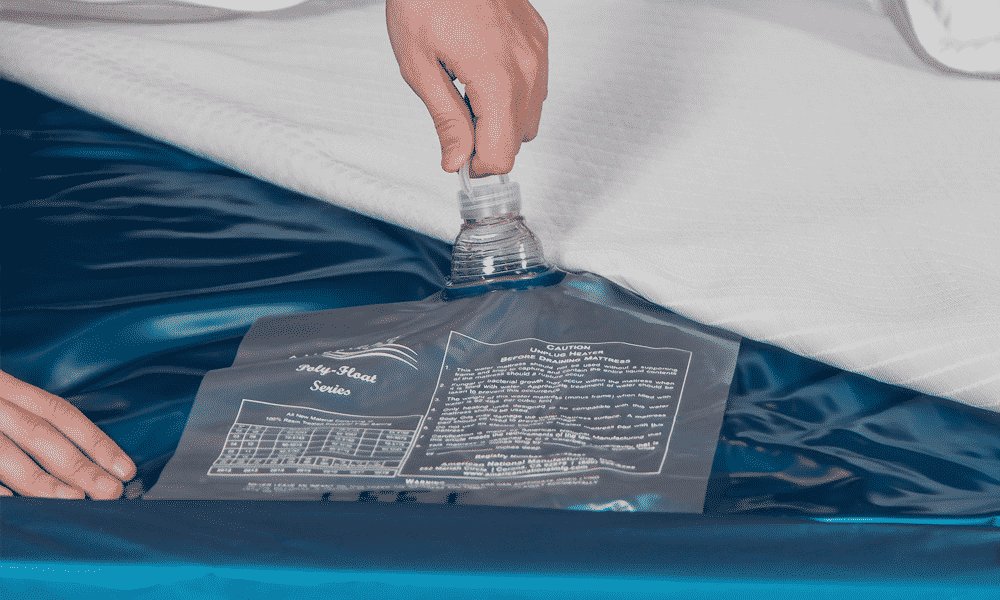

The vinyl used in waterbed mattresses is durable and strong and unlikely to burst, but accidents can happen, especially when draining or filling your waterbed. Our article about how to properly drain a waterbed will help you avoid these types of mishaps. You may also find our article on air bed dangers and how to fix them interesting as the points discussed could be applied to waterbeds as well.

Here we list common reasons why you may need waterbed liability insurance:

1. It Is Required By Your Landlord

A landlord may require you to purchase waterbed liability insurance so that he/she won’t have to endure the exorbitant cost of water damage resulting from a waterbed accident. Should you decide that it is time to change your bed so that you don’t have to purchase extra liability insurance, we suggest making use of waterbed removal services so that the bed is disposed of responsibly and that the different components are recycled where possible.

2. For Peace Of Mind

Even if your landlord doesn’t require waterbed liability insurance from you, having a waterbed is a huge responsibility and you should definitely invest in an insurance policy because it will save you a lot of hassle and money in the future. Owning a waterbed also means that you need to take care of it differently than you would a regular mattress. Be sure to read our tips for waterbed maintenance and care to ensure you’re making the right choices to protect your waterbed.

3. To Be Prepared

Insurance by its very nature is something that you buy for “what ifs”. It’s one of those grudge purchases that you’ll be glad you have when water is suddenly pooling around your bed and leaking into the rest of your building. For more information, be sure to take a look at these common waterbed issues and how to fix them.

Should you decide that you would rather opt for a different type of bed due to the complications associated with waterbeds, why not check out our article that outlines what mattresses orthopedic doctors recommend. You may want to look at an orthopedic mattress like this or an air bed like this.

Additionally, you may find interest in a related article that answers other common waterbed questions such as do you need a mattress for a waterbed? So be sure to take a look at that as well.

How to Choose a Durable Water Bed to Minimize Liability

Choose a waterbed that has a sturdy frame and good quality vinyl mattress, has a decent guarantee, and is recommended by doctors and websites that offer sleep-related information and honest customer reviews.

To choose a durable water bed and minimize liability, buy a high-quality, durable waterbed with a guarantee from the manufacturer, good reviews, and doctors’ recommendations.

Choosing a high-quality waterbed with excellent customer reviews will help reduce the chances of waterbed-related accidents. Image Source: SouthWestWaterbeds.co.uk. ALT: Choose a waterbed that has a sturdy frame and good quality vinyl mattress.

Do Major Insurance Companies Offer Waterbed Liability Insurance?

Usually, most insurance companies offer full coverage against the damage and loss of all kinds of furniture and goods present in your home. Waterbeds are considered to be separate from other types of furniture and you will need to find out if one is covered by your policy.

Most major insurance carriers offer waterbed liability insurance. This coverage may be included in a policy or may need to be specified. It is the responsibility of each individual to find out about waterbed coverage, to avoid a rejected claim later.

How To Acquire Waterbed Liability Insurance

To get waterbed liability insurance first you need to contact the company you bought the waterbed from and check if they offer any additional insurance. Waterbed manufacturers and retailers will often be able to recommend an insurer that offers this type of coverage if they don’t.

To acquire waterbed liability insurance, first review the current home insurance policy, then determine if the current home insurance carrier provides waterbed liability insurance. Next, contact the home insurance provider and purchase a separate liability insurance policy or an addendum to the existing policy to cover the waterbed.

Here are the four steps to acquiring waterbed liability insurance:

Step 1 – Review Your Current Policy

The first step in acquiring waterbed liability insurance is to review your current insurance policy to check your coverage and premium. If waterbed insurance needs to be added to your current policy you should talk to your household contents insurance providers and ask them to add the appropriate addendum.

Step 2 – Determine Whether Your Current Insurance Carrier Offers This Type Of Coverage

If your current insurance carrier offers this kind of insurance coverage then it is better to trust them with one additional liability insurance addendum rather than looking for new insurance companies.

Step 3 – Look For Reasonable Rates

You should take a look at the cost of your current insurance policy plus the additional cost of the liability insurance of your waterbed, which could cost an additional $10-$20 a month.

Step 4 – Look For Monthly Payment Policies

Make sure that you choose an affordable and appropriate liability policy that has monthly installments that fit your budget but still provides adequate coverage.

Key Takeaways

Essential Coverage

Waterbed liability insurance is crucial as it covers the repair or damage costs to property resulting from waterbed-related mishaps. Accidents such as leaks or holes in the waterbed mattress can lead to significant water damage to furniture and the property, emphasizing the importance of having this insurance.

A Wise Financial Shield

Typically covering claims up to about $300,000 and costing between $25 and $100 per month, waterbed liability insurance acts as a financial shield. Particularly for tenants, a leaking waterbed can cause extensive damage not only to their apartment but also to neighboring units, potentially leading to hefty repair bills which this insurance can cover.

Landlord Requirements

In some rental scenarios, landlords may require tenants to have waterbed liability insurance to safeguard against the high costs of water damage resulting from a waterbed accident. It’s a precautionary measure to ensure that the costs of any damage won’t be a burden on the landlord or other tenants.

Peace of Mind

Having waterbed liability insurance provides peace of mind to waterbed owners. Knowing that the expenses resulting from accidental leaks or other waterbed-related damages will be covered helps in maintaining a stress-free living environment.

Different from General Liability Insurance

Waterbed liability insurance is distinct from general liability insurance. It’s often an additional coverage or an addendum to an existing insurance policy, specifically catering to the damages caused by waterbed mishaps which may not be covered under general liability insurance.

Choosing a Durable Waterbed

Opting for a high-quality, durable waterbed with a solid frame, good quality vinyl mattress, and reputable manufacturer’s guarantee can minimize the likelihood of accidents, subsequently reducing the liability. Ensuring proper maintenance and care of the waterbed also plays a vital role in preventing potential accidents and damages.

Availability with Major Insurance Companies

Most major insurance carriers offer waterbed liability insurance, either as a specified coverage or included in a broader policy. It’s advisable to review the current insurance policy and consult with the insurance provider to ensure the waterbed is adequately covered, ensuring a well-informed and secure insurance arrangement.

Acquisition Steps

Acquiring waterbed liability insurance involves reviewing the existing insurance policy, checking if the current insurance carrier offers this coverage, looking for reasonable rates, and opting for a policy with affordable monthly installments. Following these steps ensures a smooth acquisition process and adequate coverage against waterbed-related damages.