Are you tired of restless nights spent tossing and turning on an uncomfortable mattress? You deserve the luxury of a peaceful slumber, and bad credit should never hinder your dreams.

In this comprehensive guide, we unveil the secret to achieving those restful nights you’ve been longing for – mattress financing with bad credit.

We understand that traditional financing options may have let you down in the past, but fear not. We’re here to introduce you to a game-changing solution: Saatva’s partnership with Affirm.

With their innovative financing program, you can finally say goodbye to sleepless nights and hello to the mattress of your dreams.

Join us as we explore the world of affordable, accessible, and comfortable sleep, no matter your credit history.

Discover Our #1 Top-Rated Mattress with Easy Financing Options

Understanding Bad Credit

Bad credit can be a significant roadblock when seeking financing for essential purchases like a mattress. It’s a reflection of your past financial behavior, including late payments, defaults, or high credit card balances.

With a poor credit score, traditional lenders may turn you away. However, don’t despair; there are still options available to help you achieve a better night’s sleep, and Saatva’s partnership with Affirm is a prime example.

Defining bad credit and its implications

Bad credit is a financial state where an individual’s credit history indicates a higher risk for lenders. This can result from missed payments, outstanding debts, or bankruptcy.

The implications of bad credit are far-reaching, affecting your ability to secure loans, credit cards, and even housing.

Thankfully, Saatva, in collaboration with Affirm, offers a lifeline for those with less-than-stellar credit, making quality mattresses accessible to everyone.

How credit scores are determined

Credit scores are numerical representations of your creditworthiness, typically ranging from 300 to 850. Several factors influence your score, including payment history, credit utilization, length of credit history, types of credit, and recent inquiries.

Saatva’s partnership with Affirm recognizes that these scores don’t define your entire financial story, making it easier for you to finance a premium mattress and rebuild your credit.

The impact of bad credit on financing options

When your credit score is less than perfect, traditional financing options may come with high-interest rates or outright denials. This can leave you feeling stuck with an uncomfortable mattress that negatively affects your sleep quality.

Saatva, in collaboration with Affirm, offers a way out of this predicament. Their flexible financing options ensure that bad credit doesn’t hinder your pursuit of a peaceful night’s rest.

Exploring Mattress Financing Options

When it comes to securing the mattress of your dreams, there are various financing avenues to consider.

You have choices from traditional routes like bank loans and credit cards to specialized mattress financing companies, retailer financing programs, and in-house options offered by mattress stores.

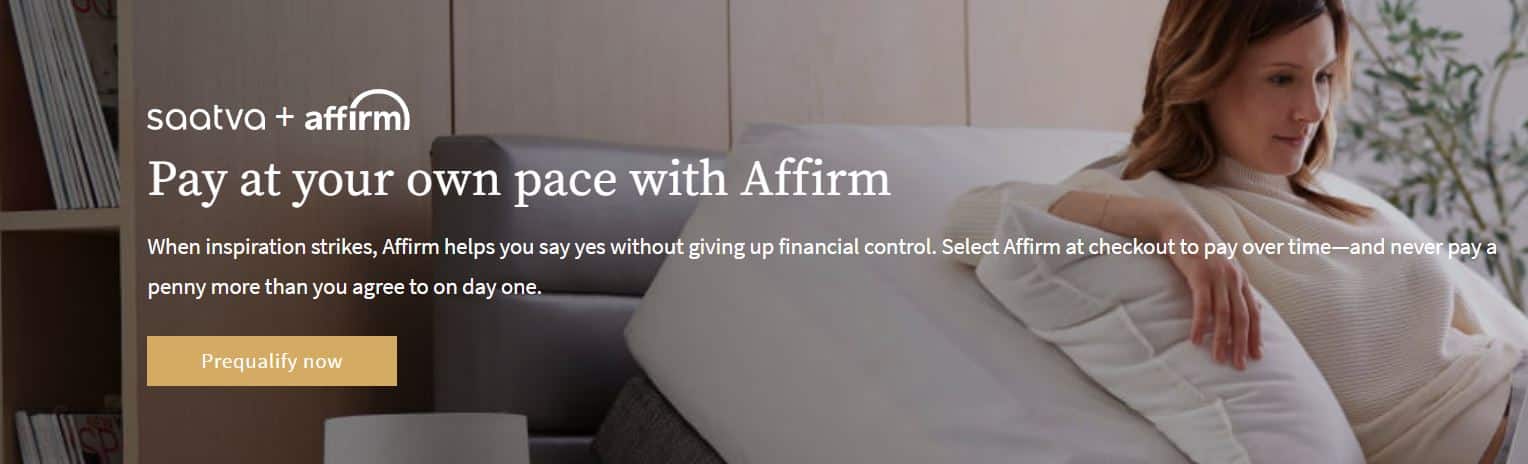

For those with less-than-ideal credit, Saatva’s partnership with Affirm stands out as a flexible and accessible solution.

Traditional financing routes

Traditional financing methods often involve obtaining a bank loan or using credit cards. However, these routes can be challenging for individuals with bad credit.

High-interest rates and stringent approval criteria may make securing the financing needed for a comfortable mattress difficult. Saatva, in collaboration with Affirm, offers a more inclusive approach, making quality sleep attainable for all.

Specialized mattress financing companies

Specialized mattress financing companies cater specifically to those in search of comfortable sleep solutions. Unlike traditional lenders, these companies often consider a broader range of credit profiles.

Saatva’s partnership with Affirm exemplifies this approach, offering competitive rates and flexibility that align with your unique financial circumstances.

Retailer financing programs

Many mattress retailers offer financing programs to entice customers. While these can provide convenience, they may come with limitations or high-interest rates, particularly for those with bad credit.

Saatva, in conjunction with Affirm, breaks these barriers, allowing you to enjoy top-tier mattresses without compromising on affordability or quality.

In-house financing from mattress stores

Some mattress stores provide in-house financing options. While this can be a viable choice, it may lack the flexibility and accessibility Saatva’s partnership with Affirm offers.

By choosing Saatva, you not only enhance your sleep but also open doors to improved creditworthiness through responsible financing.

Benefits & Drawbacks of Different Financing Options

Exploring financing options for your mattress purchase comes with pros and cons. It’s essential to weigh these factors carefully to make an informed decision.

Interest rates & repayment terms

Traditional financing methods often bring higher interest rates, increasing the overall cost of your mattress. Saatva’s partnership with Affirm offers competitive rates and flexible repayment terms, making it an attractive option for those seeking affordability and comfort.

Credit checks & approval requirements

Many financing routes involve rigorous credit checks and stringent approval criteria, limiting accessibility. Saatva’s collaboration with Affirm welcomes a broader range of credit profiles, ensuring that bad credit doesn’t exclude you from a good night’s sleep.

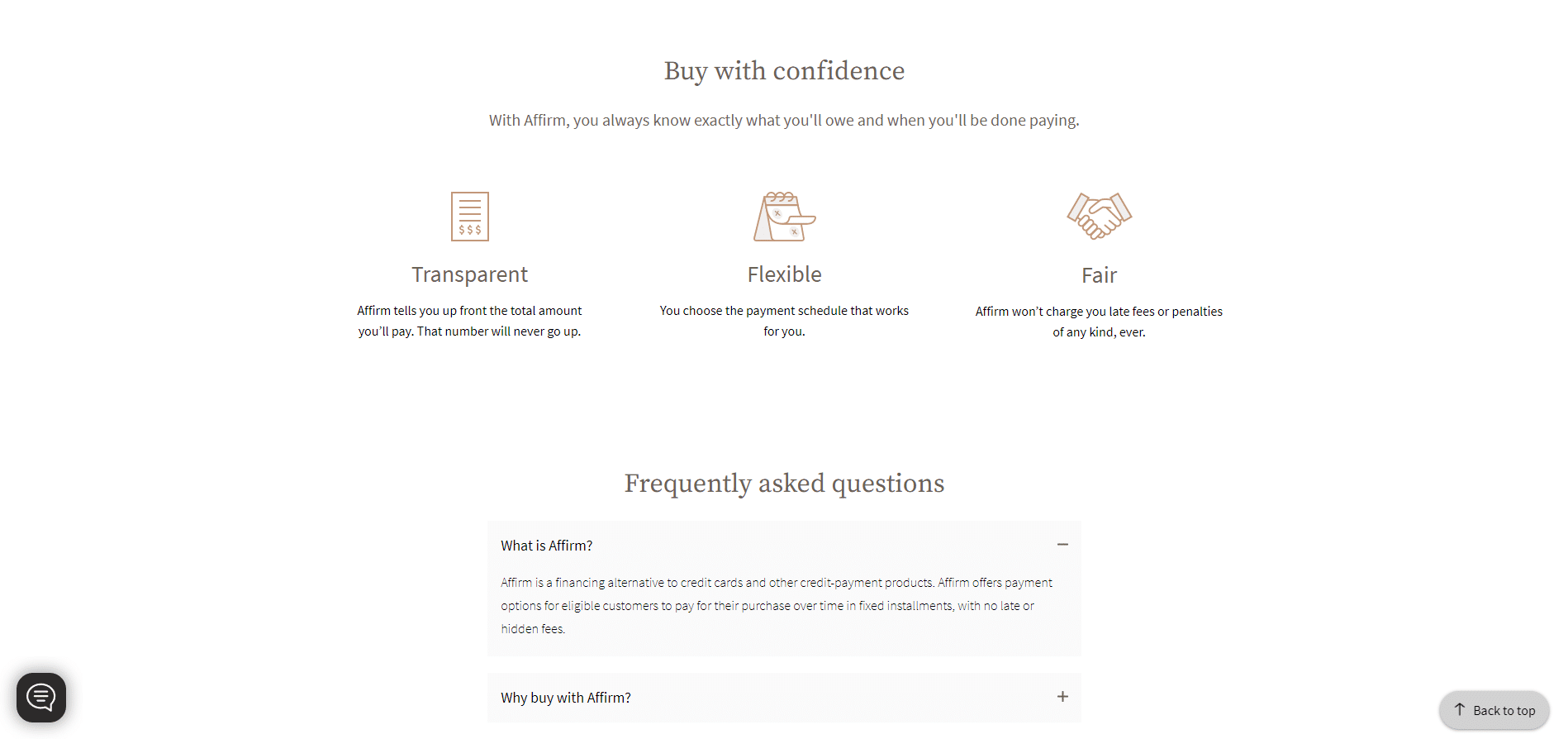

Hidden fees and potential pitfalls

Hidden fees and unexpected costs can lurk within some financing agreements, potentially leading to financial stress. Saatva and Affirm’s transparent approach eliminates such concerns, allowing you to budget effectively and enjoy your new mattress with peace of mind.

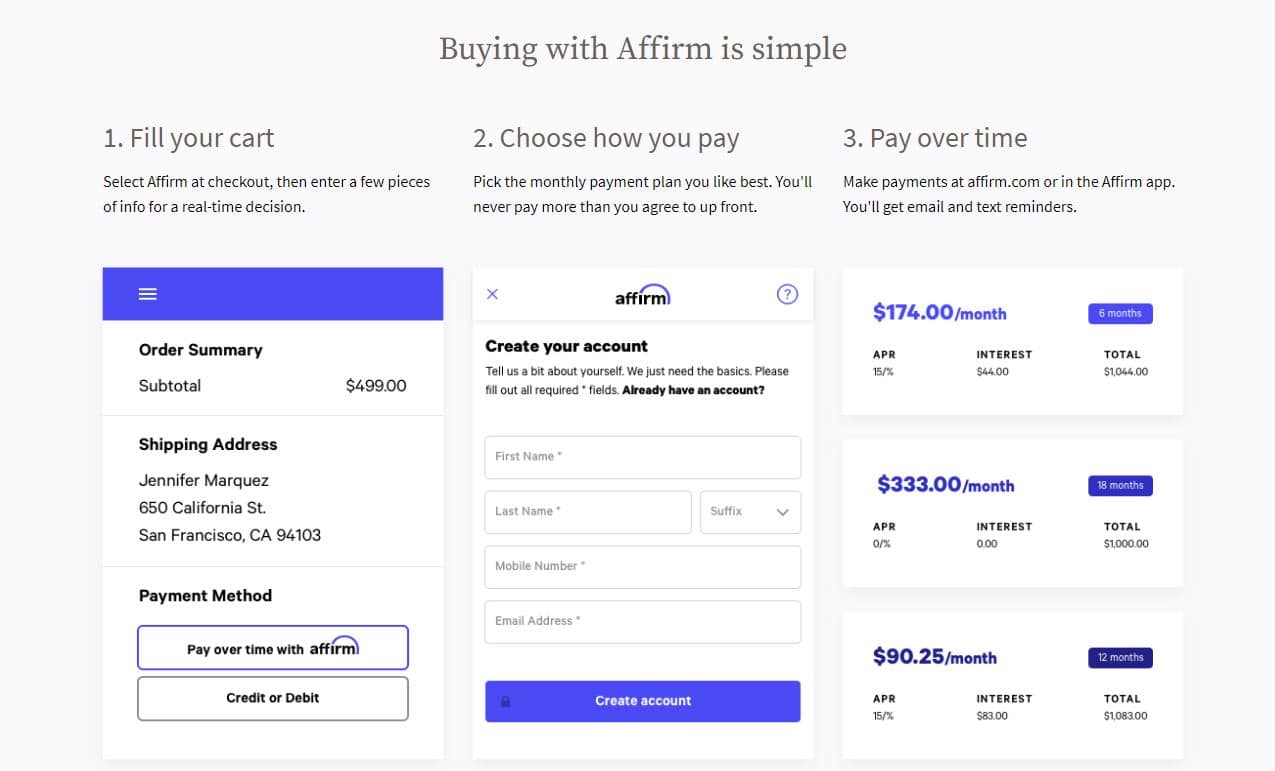

Flexibility & convenience factors

Convenience and flexibility play a pivotal role in the financing process. Saatva and Affirm prioritize customer ease, offering online applications, quick approvals, and manageable repayment schedules.

This ensures that you sleep soundly on your new mattress and rest easy knowing you’ve chosen a reliable financing option.

Specialized Bad Credit Mattress Financing

Specialized mattress financing options provide a tailored solution for those with poor credit. Here, we delve into companies that cater specifically to individuals facing credit challenges and how to navigate their unique offerings.

Companies specializing in financing for individuals with poor credit

Several companies specialize in providing financing options to individuals with less-than-perfect credit histories. Among these, Saatva’s collaboration with Affirm stands out, offering a seamless path to a high-quality mattress while accommodating a diverse range of credit profiles.

Understanding their unique lending criteria

Specialized bad credit mattress financing companies often have more lenient lending criteria compared to traditional lenders. Saatva and Affirm, for instance, prioritize affordability, making it easier for individuals with less-than-ideal credit to secure financing for the mattresses they desire.

How to apply & what to expect in the application process

With user-friendly online applications, applying for specialized bad credit mattress financing is typically straightforward. Expect a simplified approval process with Saatva and Affirm, where timely decisions and flexible repayment terms ensure you can transform your sleep environment without undue financial stress.

Improving Your Credit for Better Financing Options

Enhancing your credit score opens doors to improved financing choices. Here, we discuss practical steps to boost your creditworthiness and secure the best possible mattress financing options.

Steps to take to rebuild or improve your credit score

Rebuilding credit involves responsible financial practices, such as timely bill payments and reducing outstanding debts. Saatva’s partnership with Affirm provides an opportunity to rebuild credit while enjoying the comfort of a premium mattress.

Monitoring your credit report for errors

Regularly reviewing your credit report is essential to identify and rectify errors. Saatva’s financing through Affirm encourages financial responsibility, promoting accurate reporting and better credit health.

Patience and persistence in credit repair efforts

Improving your credit score takes time and dedication. Saatva and Affirm support your journey by offering financing solutions that allow you to demonstrate financial responsibility, paving the way for better financing options in the future.

Tips for Successful Mattress Financing with Bad Credit

Securing mattress financing with bad credit is possible with the right approach. Discover valuable tips to make your financing journey smooth and effective.

Budgeting and assessing affordability

Before committing to a financing option, assess your budget and ensure that monthly payments are manageable. Saatva’s collaboration with Affirm offers transparent terms, making budgeting for your new mattress easier without straining your finances.

Negotiating terms with lenders or retailers

Don’t hesitate to negotiate terms with lenders or retailers, including interest rates and repayment schedules. Saatva’s partnership with Affirm encourages open communication, ensuring you secure favorable terms that align with your financial situation.

Seeking cosigners or guarantors if necessary

If your credit history poses challenges, consider seeking a cosigner or guarantor to enhance your approval chances. Saatva and Affirm offer flexibility, accommodating a variety of financial arrangements to make your mattress purchase accessible.

Reading and understanding financing agreements

Thoroughly review and understand all financing agreements to avoid surprises. Saatva’s financing with Affirm emphasizes transparency, ensuring you have a clear understanding of the terms and conditions empowering you to make an informed decision for a restful night’s sleep.

Alternative Solutions

When traditional financing isn’t ideal, alternative options can provide a path to acquiring a comfortable mattress. Let’s explore some alternative strategies to secure the mattress of your dreams.

Exploring alternatives to traditional financing

Consider unconventional approaches when facing credit challenges. Saatva’s collaboration with Affirm offers a flexible financing solution that caters to various credit profiles, making it an attractive alternative to conventional options.

Layaway Plans and rent-to-own options

Layaway plans and rent-to-own arrangements provide flexibility by allowing you to pay in installments. However, these can sometimes come with higher overall costs. Saatva and Affirm offer competitive rates, making them a preferable alternative for long-term value.

Consideration of refurbished or budget-friendly mattresses

Exploring refurbished or budget-friendly mattresses is another way to save on your sleep investment. Saatva’s partnership with Affirm enables you to access high-quality mattresses without compromising on comfort or durability, making it a superior alternative to settling for less.

Conclusion

In the pursuit of restful nights and ultimate comfort, your credit history should never be a barrier. We’ve explored the world of mattress financing, focusing on individuals facing bad credit.

Traditional financing can be challenging, but Saatva’s partnership with Affirm offers a beacon of hope. Their inclusive approach welcomes diverse credit profiles, providing accessible and flexible financing solutions.

We’ve also discussed alternative routes, but none offer the combination of affordability and quality quite like Saatva. By choosing Saatva and Affirm, you secure a comfortable mattress and embark on a journey toward financial recovery and better sleep, proving that a peaceful night’s rest is within reach for everyone.