A good quality mattress is important for a restful and long-lasting night’s sleep. Before purchasing a mattress, we study its various features and aspects thoroughly. It brings contentment to our purchase decision and makes it a long-term investment.

Investing in a good-quality mattress can be difficult for some people. That is where the mattress financing comes into play. Financing is a convenience that allows buyers to acquire a bed without paying the total cost. Instead, they pay it in intervals, with sometimes a little interest rate.

Most such mattresses are expensive due to their unique features and qualities. For instance, various brand mattresses sold by Mattress Firm aren’t that cheap or affordable. However, luckily, they offer their customers a convenient financing plan to make them feel affordable.

In the article below, we will look into the financing options that Mattress Firm offers at their stores.

Discover Our #1 Top-Rated Mattress with Easy Financing Options

How Does Mattress Financing Work?

Mattress financing has various aspects or terms and conditions to consider. As a buyer, you must consider them all before the purchase. Otherwise, instead of being a convenience, it can become a painful or difficult process, especially in the long term.

The below explains these simple and common steps involved in mattress financing.

Choosing your Mattresses

It starts with the buyer choosing his desired mattress, which you can do online or in-store checking. It helps them with an insight into the features and qualities of that particular mattress. Check about the mattress’s size, comfort level, materials, and other important aspects.

Finance Applying

Next, you need to apply for the financing process. Most sellers offer in-house and third-party lenders financing options, both of which are fine. However, they must review financial or personal information before applying or confirming the financing facility.

Credit Score Check

Most lenders also go through the buyer’s previous credit score or history. This helps them to learn about the buyer’s creditworthiness.

The main reason is to determine whether the buyer can complete the financing plan easily in the future considering the terms and conditions and interest rate they have agreed to. So, credit score with most sellers also plays a crucial role when applying for mattress financing.

Singing the deal

Once the seller or lender checks and verifies all the requirements, they sign financing contracts. It has all the terms and conditions with further relevant and agreed details on which the buyers agree to purchase the mattress via financing.

Terms Approval

Once approved, the buyer receives all these details through various channels. It can include an email and a hard copy of the contract via SMS. As for the interest rate, some well-recognized sellers offer financing at zero or lower interest rates.

However, it is only for a short or a specified period. Usually, most sellers charge it, which can be a variable amount depending upon the mattress brand and model.

Payments

Once all is set, making monthly payments as agreed is time. Again, the payments can be online, in-store, through automatic deductions, or even through Cheque postal, whichever way agreed.

Completion

Once you complete all the monthly payments, you now own that mattress. You may now be able to sell it ahead or even dispose of it freely if required, which otherwise may be challenging to do in case of an ongoing payment process.

Late payments

Try to make payments on time, as it would affect your credit score for future reference.

Returns or Warranty Policies

Discuss the returns or warranty terms before proceeding with the financing contract agreement. It can help in the future with easy returns or warranty claim, which varies from one financing plan to another.

What Financing options does Mattress Firm offer?

Mattress Firm offers different financing facilities to its buyers. Check them out below:

Mattress Firm Credit Card

With Mattress Firm, it is possible to finance a mattress using a credit card. However, you must consider other options before proceeding with them.

Although Mattress Firm offers some specific no-interest loan options, others may offer a longer loan period with more value in return. Moreover, Forbes reports that its rates are comparatively and disproportionately high.

Progressive Leasing

The progressive leasing option allows you to purchase a mattress with Mattress Firm without paying the total amount upfront. Mattress Firm has this option for buyers who need a new or an expensive luxury mattress but need more money to afford to pay in a lump sum upfront.

Affirm

Affirm is a financial lender that offers installment loans to various consumers. Luckily, Mattress Firm also offers financing through Affirm, making purchasing any desired mattress hassle-free. However, they have different payment plans that you must discuss in detail before proceeding further.

CareCredit

Mattress Firm also facilitates its customers with mattress financing using CareCredit. CareCredit, which has the parent company named Synchrony Bank, directly supervises all the financial financing payments made by CareCredit, who has affiliation with Mattress Firm’s own issued credit card.

What is Mattress Firm or Synchrony Home Credit Card?

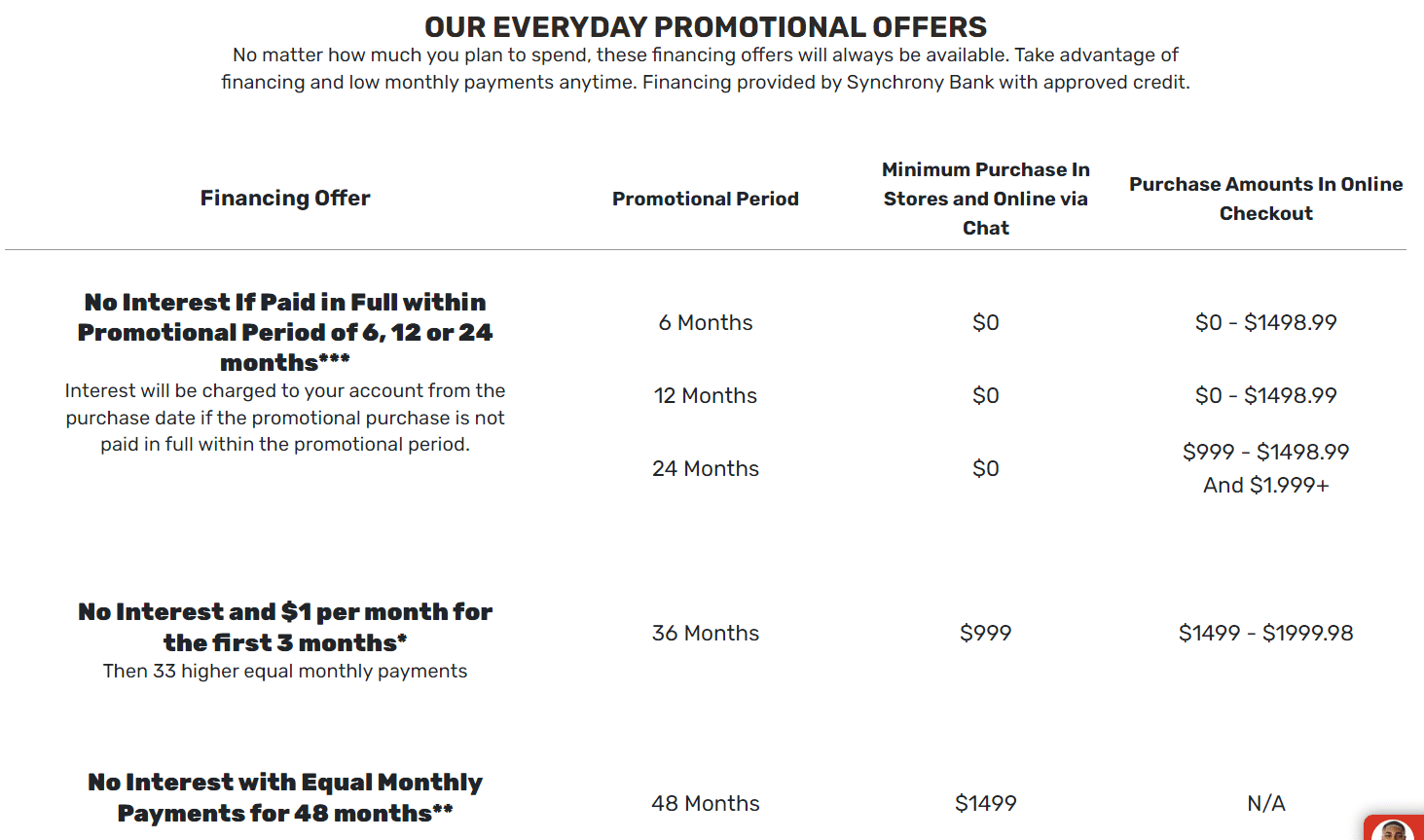

Mattress Firm has an affiliation or partnership with Synchrony Bank. They offer a “Mattress Firm Synchrony Home Credit Card.” The card is available for Mattress Firm customers to purchase mattresses in-store or online.

The card is available to use by customers under various terms and conditions. Mattress Firm offers different financing options on their Synchrony Home Credit card. It can include different interest rates and different financing periods. Depending upon the mattress brand, their duration can last between 6-48 months.

The card validates and determines the buyer’s previous credit history with Mattress Firm. Above that, it allows for special financings, attaining flexible plans, managing online accounts, exclusive offers, and much more.

What is a 3% cash back offer on Mattress Firm?

We all love to have further convenience over a facility or comfort we have already been offered. The same is the case with the Mattress Firm’s 3% cash-back offer. The offer adds more value to your financing deal. Using their 3% cash back offer, customers who purchase luxury a mattress above $1999+ amount have a 3% discount.

However, this only applies to mattresses above the price of $1999+ and not any less. Moreover, the offer is already ongoing and is valid till 3rd October. In addition, to benefit from this offer, you must pay via Visa® mail, and a rebate form is also required.

Can you buy a mattress on lease from Mattress Firm without credit card?

Buying a mattress should be hassle-free and without any delays. However, sometimes, it can be difficult to afford certain luxurious mattresses due to their high-priced value.

That is where mattress financing comes into play and offers convenience. However, most financing facilities require a good credit history or Credit cards to acquire them.

Luckily, with Mattress Firm, it is no longer a compulsion. Buyers who do not have a credit card can also apply for Mattress Firm’s mattress financing options. They do not require any Visa or other credit card option. They offer their “Mattress Firm Synchrony Home Credit Card” for those who don’t own one.

Is it easy to get credit at Mattress Firm?

Getting credit can take time for some buyers. Especially those who have a poor or bad credit score or history can have an even more difficult time.

With Mattress Firm, they do offer a convenient mattress financing option. But, it is challenging for everyone to become eligible for it. Despite advertising it as an easy-to-get financing service, they require a good and appealing credit score or history.

What credit score do you need for Mattress Firm?

Credit score makes a huge difference when applying for financing anywhere. Especially when it comes to high-priced mattresses with a distributor like Mattress Firm, they require a good credit Score.

At Mattress Firm, they usually require a Mattress Firm Credit Card with at least 600 points or more. Otherwise, they would consider it as a fair credit score. Moreover, a lower score can lead to a higher APR and a further complication in financing approval.

What forms of payment does Mattress Firm accept?

Mattress Firm accepts different modes of payment for purchasing. This includes MasterCard, Visa, Discover, and American Express. With that, they even accept cash and check after confirmed identification. Buyers must visit online or their store to use their special financing option for making a purchase.

Conclusion

Financing is a comfortable and quick way to purchase a luxurious or expensive mattress, which otherwise can be challenging to buy. However, it has its requirements and limitations. Therefore, even when choosing financing options, we recommend exploring and considering different options to get the best deal.

One such option can be the Saatva financing option with Affirm. It is better than the Mattress Firm offers and has a hassle-free acquisition process. They offer different monthly packages of 6-12- and 18 months with zero interest rates. Above that, the Saatva mattresses have a top-notch quality and are highly comfortable.