Finding the perfect mattress is the first step to a good night’s sleep. The next challenge you’ll have to deal with is paying for it comfortably without a credit check.

Fortunately, there’s a solution that ensures you can enjoy the mattress of your dreams without any financial stress. Enter Saatva’s financing option in partnership with Affirm, a game-changer in the world of mattress shopping.

This post will explore how this innovative payment plan empowers you to sleep soundly, literally and figuratively, while sidestepping credit checks. Say goodbye to restless nights worrying about your budget and hello to the blissful sleep you deserve.

Discover Our #1 Top-Rated Mattress with Easy Financing Options

Understanding No Credit Check Financing

No credit check financing, like Saatva’s partnership with Affirm, offers a lifeline to those who might not have a pristine credit history.

This option allows customers to purchase a quality mattress without the worry of traditional credit checks, making it accessible to a broader audience.

What’s “no credit check financing,” and what’s its significance?

No credit check financing, such as Saatva’s collaboration with Affirm, eliminates the need for a credit history assessment when securing a mattress payment plan.

This approach is significant as it provides an inclusive and stress-free way for individuals to invest in better sleep. It opens doors for those who might have faced hurdles due to past financial issues.

How do traditional credit checks impact loan approvals?

Traditional credit checks can be a roadblock for many individuals seeking financing. These checks often consider past financial missteps, making it difficult for some to secure loans or payment plans. Saatva’s financing option with Affirm bypasses this issue, ensuring a fair chance at a comfortable mattress.

The benefits of financing without a credit check

As exemplified by Saatva and Affirm’s partnership, financing without a credit check offers several advantages. It promotes financial inclusivity, allowing people with varying credit histories to enjoy a high-quality mattress.

Furthermore, it simplifies the purchase process, making acquiring the mattress of your choice easier without the stress of credit checks. With Saatva and Affirm, better sleep is within everyone’s reach.

Exploring Mattress Payment Plan Options

When it comes to securing a new mattress, there are various payment plan options to consider, catering to different needs and financial situations.

Here, we’ll delve into the world of mattress financing and highlight specialized financing companies, retailer-specific plans, and in-house financing options, with a special focus on Saatva’s partnership with Affirm.

Specialized financing companies offering no credit check plans

Companies like Saatva have partnered with specialized financing firms like Affirm to provide no-credit-check mattress financing. These options offer flexible payment plans and can be a lifeline for those with less-than-perfect credit histories, making premium mattresses more accessible.

Retailer-specific payment plans

Many mattress retailers offer their own financing plans. While these can vary, they often provide attractive terms, including low or zero-interest options. Saatva, in collaboration with Affirm, sets a high standard in this category, offering competitive rates and hassle-free application processes.

In-house financing options from mattress stores

Some mattress stores offer in-house financing, allowing customers to buy and pay for a mattress over time. While these plans can be convenient, they may come with credit checks.

Saatva’s partnership with Affirm stands out for its no-credit-check approach, ensuring more people can enjoy quality sleep without financial stress.

Benefits & Drawbacks of No Credit Check Financing

No credit check financing, exemplified by Saatva’s collaboration with Affirm, offers accessibility and convenience. It’s a boon for individuals with less-than-ideal credit histories.

However, interest rates may be slightly higher, and repayment terms should be carefully considered to avoid any potential drawbacks.

Accessibility for individuals with poor or no credit history

Saatva and Affirm financing options extend a welcoming hand to individuals who have struggled with credit in the past. It provides an opportunity for those with poor or no credit history to invest in quality sleep, promoting financial inclusivity.

Interest rates, fees, and repayment terms

While no credit check financing can be a game-changer, it’s essential to be aware of interest rates, fees, and repayment terms. Saatva’s partnership with Affirm offers competitive rates and transparent terms, making it a favorable choice in this regard.

Comparison with traditional financing options

Compared to traditional financing options that often hinge on credit checks, Saatva’s no-credit-check financing with Affirm provides a more accessible route to owning a premium mattress.

It empowers individuals with financial flexibility, ensuring quality sleep is within reach, regardless of credit history.

Applying for a No Credit Check Mattress Payment Plan

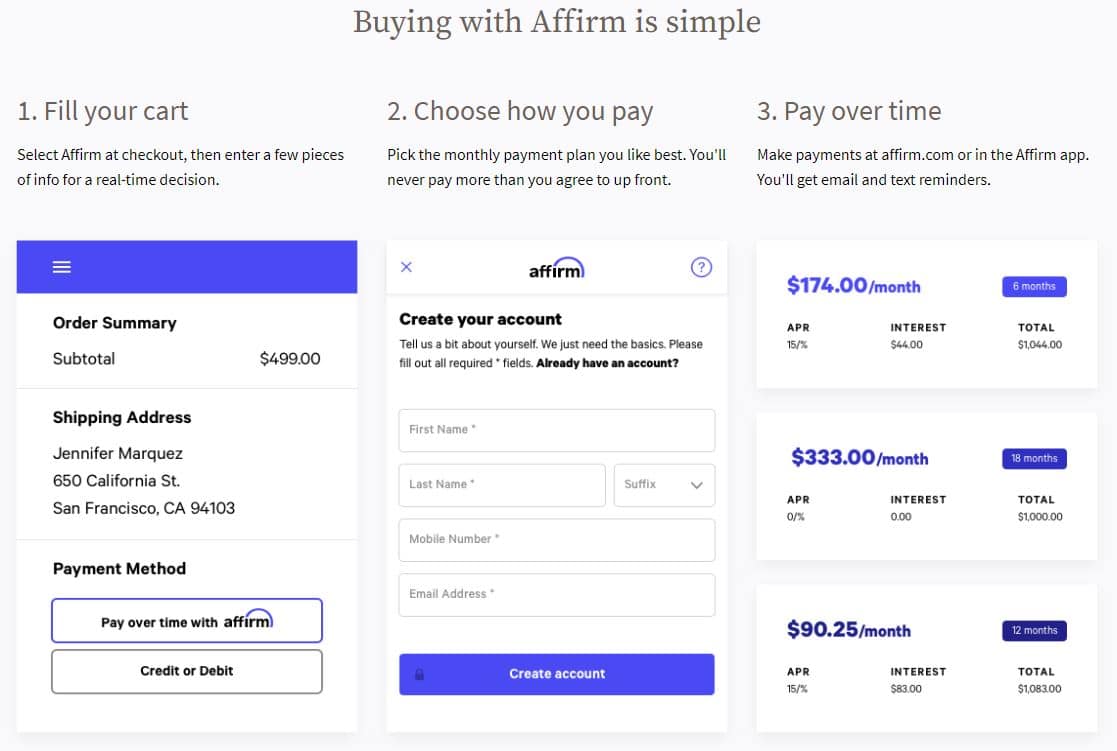

The application process is straightforward and convenient when considering a no-credit-check mattress payment plan like Saatva with Affirm.

How do you initiate the application process?

To get started with Saatva’s financing through Affirm, simply visit their website or store, select your desired mattress, and choose Affirm as your payment option during checkout. The application process is quick and user-friendly.

Required documentation and information

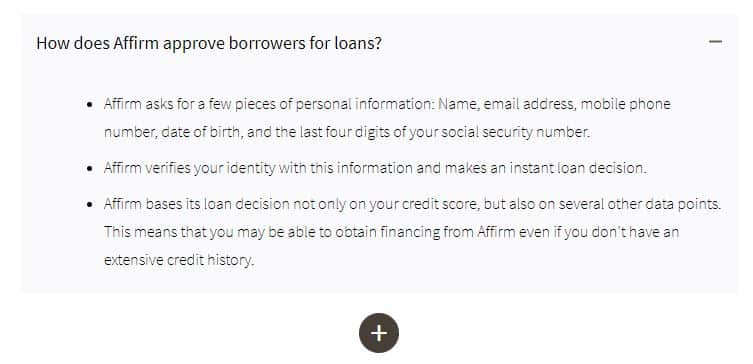

Typically, you’ll need to provide basic personal and financial information. Saatva and Affirm make it easy by guiding you through the necessary steps during the online application.

Approval process and timelines

Once you’ve submitted your application, Saatva and Affirm swiftly review it, often providing instant approval. This efficient process ensures you can secure your new mattress without delay, making the buying experience stress-free.

What Brands Offer No Credit Check Mattress Financing?

Several brands in the United States offer no credit check mattress financing options, making quality sleep accessible to a broader audience.

Among them, Saatva stands out with its partnership with Affirm, which allows customers to purchase premium mattresses without traditional credit checks.

Other notable brands include Purple, which also offers financing through Affirm, and Nectar, which provides financing through its in-house Nectar Financing.

Plus, Leesa and Amerisleep offer financing options through Affirm, ensuring that individuals with varying credit histories can enjoy the comfort and support of their mattresses without the burden of credit checks. These options make investing in a good night’s sleep easier than ever.

Alternative Solutions

When considering mattress financing, alternative options exist for those who may not qualify for no credit check plans like Saatva with Affirm.

Exploring layaway plans and rent-to-own options

Layaway plans and rent-to-own arrangements provide payment flexibility without credit checks. However, they may lack the instant gratification of a new mattress. Saatva and Affirm financing offer a more immediate solution.

Budget-friendly mattress alternatives

For budget-conscious buyers, considering less expensive mattress options or mattress-in-a-box brands can be a smart alternative. Saatva’s financing with Affirm ensures that premium comfort remains within reach.

Seeking cosigners or guarantors for traditional financing

Traditional financing with credit checks might require a cosigner or guarantor to secure approval. Saatva’s partnership with Affirm eliminates this need, simplifying the process and offering accessibility to a broader audience.

Conclusion

No credit check mattress financing, exemplified by Saatva’s partnership with Affirm, emerges as a beacon of accessibility and convenience.

Bypassing traditional credit checks opens doors for individuals of varying financial backgrounds to invest in quality sleep. Saatva’s competitive rates, transparent terms, and swift approval process set a high standard in the industry.

So, if you’re seeking a mattress payment plan that prioritizes your comfort and financial ease, consider Saatva with Affirm—a pathway to nights of restful slumber without the worry of credit checks. Sleep well and thrive.