A good night’s sleep is priceless, and Nectar Mattress understands the importance of restful slumber. They offer a remarkable mattress and a convenient way to make it yours through Nectar Mattress Financing.

This article will explore how this financing option can help you achieve the sleep you’ve always dreamed of without breaking the bank.

Whether you’re looking to upgrade your mattress for better comfort and support or seeking a flexible payment plan, Nectar Mattress Financing offers a solution tailored to your needs.

Well, get ready to say goodbye to restless nights and hello to a well-rested you with Nectar’s financing options.

Discover Our #1 Top-Rated Mattress with Easy Financing Options

How Does the Nectar Mattress Financing Work?

If you’ve ever wanted to invest in a premium mattress like the Nectar Mattress but were concerned about the upfront cost, Nectar’s financing options could be the key to unlocking your dream of a peaceful night’s sleep.

Nectar Mattress Financing takes the stress out of purchasing a premium mattress. It allows you to experience the comfort and support of a Nectar Mattress without the burden of a hefty upfront cost.

With flexible payment options and competitive financing terms, achieving better sleep has never been more attainable. Nectar Mattress Financing is designed with simplicity and flexibility in mind. Here’s how it works:

Choose your mattress:

Begin by selecting the Nectar Mattress model that suits your preferences. Whether it’s their classic memory foam mattress or one of their newer offerings, Nectar has various options to cater to different sleep needs.

Apply for financing:

Once you’ve chosen your mattress, you can apply for financing directly through the Nectar website. The application process is typically quick and straightforward, allowing you to decide within minutes.

Select your payment plan:

Nectar offers various financing plans with different terms and interest rates. You can choose the one that aligns best with your budget. These plans often come with low or even zero-percent APR for qualified buyers, making it easier on your wallet.

Make affordable payments:

After approval, you’ll start making monthly payments per the chosen plan. These payments are designed to be affordable and manageable, helping you spread the cost of your mattress over time.

Enjoy your new mattress:

Once you’ve completed your payments, the Nectar Mattress is all yours to enjoy. You can look forward to nights of restful sleep on a high-quality, comfortable mattress.

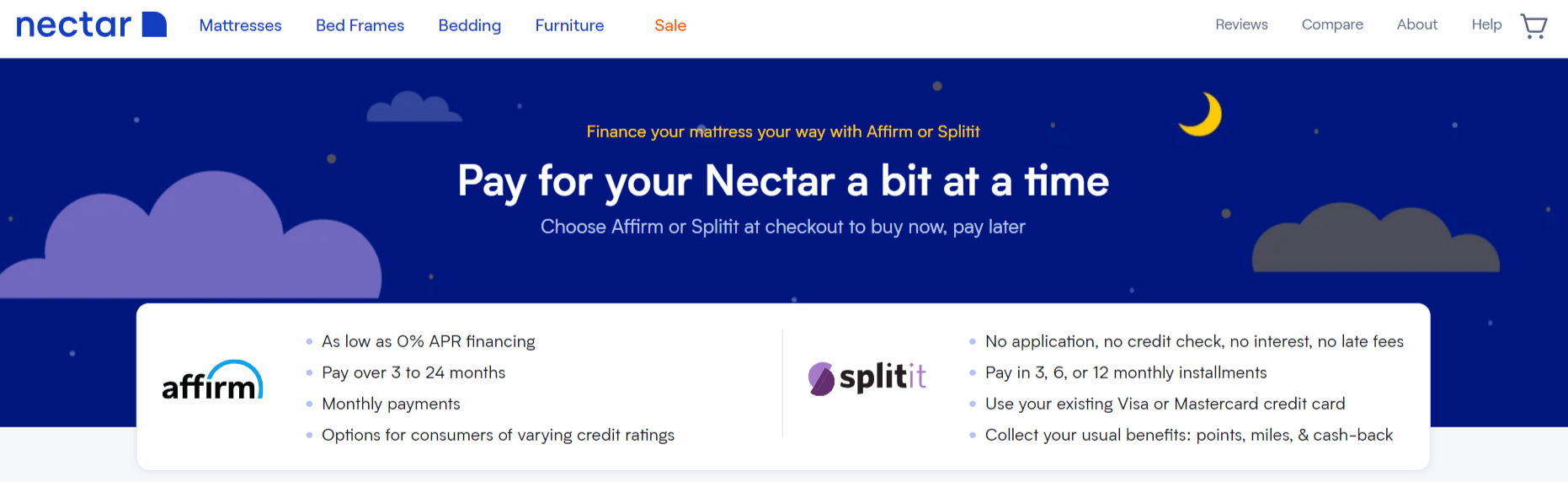

What are the Key Features of Affirm and Splitit Nectar Mattress Financing options?

Both Affirm and Splitit offer convenient financing options for Nectar Mattress purchases. Affirm involves a credit check but provides transparent terms.

At the same time, Splitit requires no credit check and charges no additional fees, making it an excellent choice for those seeking simplicity and flexibility in their financing arrangements.

Let’s look at each of these financing options in more detail.

Affirm Financing

What is Affirm?

Affirm is a popular financing option available for Nectar Mattress purchases. It allows customers to buy a Nectar Mattress and pay for it over time through easy-to-manage monthly payments.

How does Affirm work?

Affirm offers transparent and straightforward financing. When you select Affirm as your payment option at checkout, you’ll be prompted to provide some basic information for a quick credit check. If approved, you can choose from various financing terms with precise interest rates, so you know exactly what you’ll pay each month.

Does Affirm perform a credit check?

Affirm typically performs a soft credit check, which doesn’t impact your credit score. This helps determine your eligibility and the terms of your financing plan.

How do I make my payments?

Affirm simplifies payments by setting up automatic monthly withdrawals from your chosen bank account. You can also make one-time payments through the Affirm app or website.

What fees does Affirm charge me?

Affirm fees are transparent. They offer fixed interest rates; you won’t encounter hidden fees or prepayment penalties. This clarity makes budgeting for your Nectar Mattress purchase straightforward.

Splitit Financing

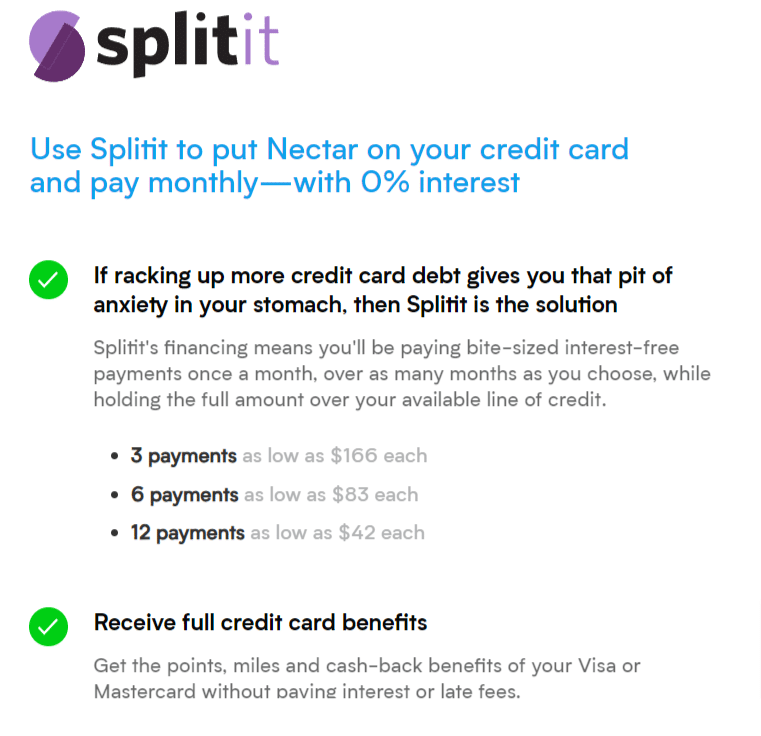

What is Splitit?

Splitit is another financing option offered by Nectar Mattress. It enables you to spread the cost of your mattress purchase into interest-free monthly installments without needing a traditional loan or credit check.

How does Splitit work?

Splitit divides the total cost of your Nectar Mattress into equal monthly payments. You’ll use your existing credit card to make these payments; no application or credit check is required.

What fees does Splitit charge me?

Splitit doesn’t charge any interest or fees to use its service. You’ll only pay for the cost of your mattress in equal installments, making it an attractive option for budget-conscious buyers.

Is there an application process for Splitit?

Unlike some financing options, Splitit doesn’t involve a formal application process or credit check. If you have an eligible credit card, you can choose Splitit at checkout and enjoy your Nectar Mattress without delay.

Does Nectar have Afterpay?

At the moment, Nectar doesn’t offer Afterpay as a financing option. However, it’s essential to note that retailers often update their payment and financing methods so that Nectar might add Afterpay or other options in the future.

We recommend visiting their official website or contacting their customer support to get the most up-to-date information on Nectar’s financing options. They can provide you with the latest details on Nectar’s payment methods for mattress purchases.

Is There a Credit Check on a Nectar Mattress?

Yes, Nectar Mattress performs a soft credit check when you choose financing options like Affirm. Soft credit checks do not impact your credit score and are typically used to assess your eligibility for financing and determine the terms of your financing plan.

However, it’s essential to check Nectar’s current financing policies, as they continue to update them over time, and they may offer different financing options with varying credit check requirements. Always review the terms and conditions provided by Nectar when considering financing for your mattress purchase.

Conclusion

In the quest for the perfect night’s sleep, choosing the right financing option can be as crucial as selecting the mattress. Nectar Mattress offers two distinct financing choices: Affirm and Splitit, each with unique features that cater to diverse needs.

Affirm provides transparency through credit checks and transparent interest rates, allowing customers to budget confidently. Splitit, on the other hand, offers simplicity with interest-free installments, eliminating the need for credit checks.

However, when comparing Nectar’s financing options with Saatva, the latter’s partnership with Affirm is a superior choice.

Saatva, known for its premium mattresses, joins forces with Affirm to offer customers a reputable financing service. Affirm performs straightforward credit checks, and their transparent interest rates ensure you can comfortably plan your payments without surprises.

This partnership combines Saatva’s exceptional mattresses with a financing solution that truly enhances the overall mattress-buying experience, making it the preferred choice over Mattress Firm’s financing for those seeking quality, convenience, and peace of mind.